Keisha Blair's Personal Financial Identity Quiz

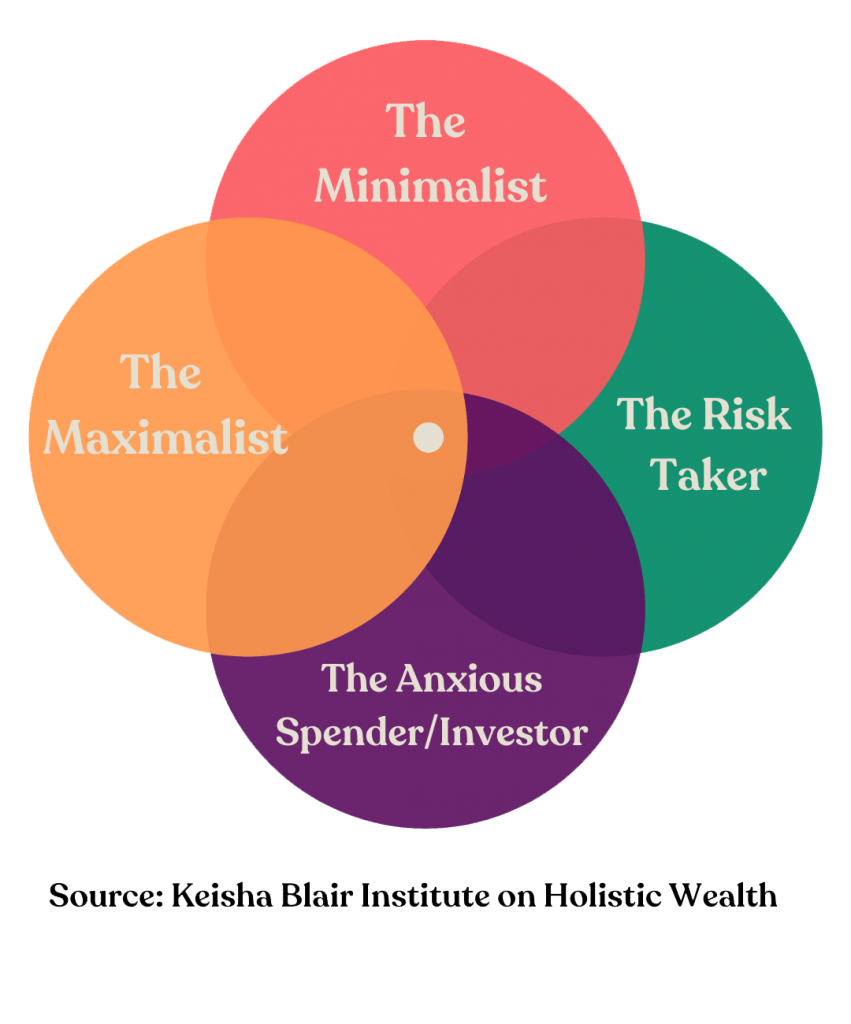

The Personal Financial Identity quiz is a tool developed by Keisha Blair, an award-winning and bestselling author. The quiz was created to meet the demand of readers who have read her book, Holistic Wealth (Expanded and Updated): 36 Life Lessons to Help You Recover from Disruption, Find Your Life Purpose, and Achieve Financial Freedom. The purpose of the quiz is to help individuals better understand their personal financial identity, which can assist them in achieving their goals, understanding others, and planning for the future.

The quiz is a valuable resource that can help individuals identify their unique financial tendencies, preferences, and behaviors. It can help individuals better understand their strengths and weaknesses when it comes to managing their finances. Furthermore, the quiz can help individuals identify the financial tendencies of others, such as spouses, parents, business partners, and managers. By understanding the tendencies of others, individuals can work with them more effectively, thus reducing conflict and increasing productivity.

The Personal Financial Identity quiz is a short, free quiz that takes about six minutes to complete. It poses a series of questions that are designed to help individuals identify their personal financial identity. The answers to the quiz are confidential, ensuring that individuals can answer honestly without fear of judgment.

In addition to the Personal Financial Identity quiz, Keisha Blair’s book Holistic Wealth offers many valuable insights and strategies for achieving financial success and overall happiness. The book emphasizes the importance of a holistic approach to wealth, including not just financial wealth, but also physical, mental, and emotional well-being.

Blair draws on her own personal experiences, as well as extensive research and interviews with experts, to provide practical advice for readers. The book includes 32 life lessons, each with a specific action plan that readers can implement in their own lives.

Overall, Holistic Wealth and the Personal Financial Identity quiz are both valuable resources for anyone seeking to improve their financial and overall well-being. They offer a fresh and holistic perspective on wealth, and provide actionable strategies for achieving success and happiness in all aspects of life.

You use things until they're completely worn out.

When I charge money to my credit card I pay it off almost immediately.

I rarely buy things impulsively I don't like spending.

Money makes me nervous.

It is important to me that I reach certain money milestones by a certain age.

Are you constantly checking your bank account balances?

I am comfortable getting into debt.

Are you constantly thinking about your next investment move?

I am always worried if I will have enough money.

I take risks often and continuously to achieve goals.

You believe that your success is in direct proportion to risks you are willing to take?

I like going on lavish vacations.

I have a hard time making money decisions and question myself after a decision is made.

I am ok with carrying large credit card balances every month.

You learn to do without.

You feel passionate in every risk you take?

Do money worries keep you up at night?

If I have extra money, I'd rather put it in savings than spend it.

I like to spend when I am happy or to celebrate an occasion.

I like to buy the highest quality product, no matter the price.

Signup for

The Personal Financial Identity Course

Just as important, knowing other people’s personal financial identities helps us to work with them more effectively. Spouses, parents, business partners, managers, can take advantage of this framework to help reduce conflict. All of our courses feature learning modules, case studies, and structured activities to help learners develop critical thinking skills to improve their lives. This course is self-paced and is a video course supplemented by other materials.